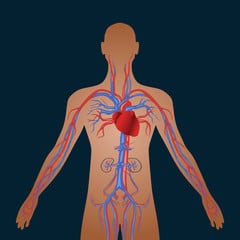

Think of Cashflow as the blood running through a business and working capital as its heart. A healthy business needs to have great cashflow and strong sources of working capital. If it has both then it has a great chance of being around a long time. If it doesn’t then its chances of survival are slim. Cashflow refers to the real-time stream of money in and out of your business. Hopefully you have customers who pay quickly and suppliers with generous terms but unfortunately this is unlikely. Obligations like payroll, taxes and loan payments are due on specific days of the month and when you get paid can become more important than how much you get paid

and that’s not a good thing.

Working capital is measured as the difference between your most liquid assets and your payables. Sources of working capital include; the cash you have in the bank, money that your bank is willing to lend you and the credit your suppliers are willing to extend you. You need to be very careful how you spend your working capital and be prepared to add more should you need it. The very best way to add more working capital is to earn a profit and keep it in the business.

You might be tempted to take on a partner or sell equity when you need more working capital. Be careful, that decision could end up being the most expensive one you’ve ever made. Newer, rapid growth and turnaround businesses are vulnerable to making this kind of decision too soon and too quickly and without considering the consequences and options.

The most familiar source of working capital is a line of credit from your bank. To qualify for one you’ll need collateral and your financial statements will have to be in good shape. Make sure the size of your line is adequate to meet your working capital needs now and in the future.

You could also consider alternative financing options like Factoring, Purchase Order Financing or Asset Based Lending (ABL) if you do not qualify for bank financing. They give you predictable cashflow and the maximum amount of working capital. You can then grow or turn around your business while you strengthen working capital and become bankable.

Supplier credit is your best source of working capital and often overlooked and undervalued. There is usually no interest, collateral, equity dilution or personal guarantees required. You can accomplish a lot with the support of your suppliers. It’s important for you to communicate well, always pay on time and if they offer you any kind of discount take it.

Sales and profitability are the most important things in your business but it’s hard to focus on them when you’re having cashflow problems. Monitor your cashflow closely and make sure it always flows smoothly. Take good care of your working capital and keep it strong. The health of your business depends on it.